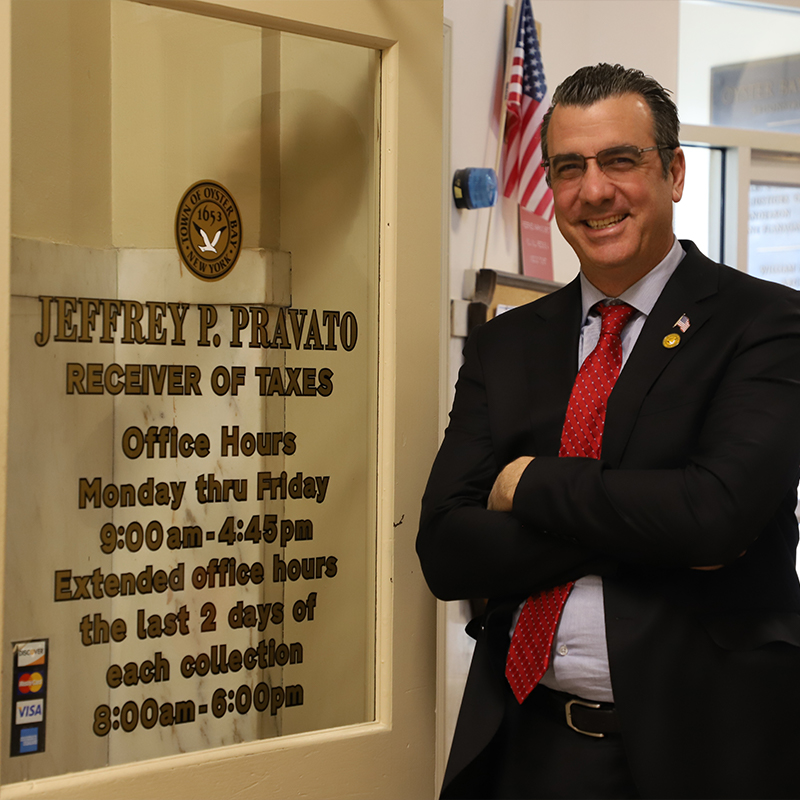

Receiver of Taxes Jeffrey P. Pravato

(516) 624-6400

receiveroftaxes@oysterbay-ny.gov

This office handles the billing of property taxes on more than 100,000 parcels of land in the Town and acts as a collection agency for the State (Supreme Court), County, Town, special district and school district taxes based upon budgets adopted by the respective municipal authorities.

In addition to the billing and receiving, the Receiver of Taxes Office has the responsibility of maintaining records and maps of each parcel of land in the Town. To maintain efficiency, the Receiver of Taxes Office has expanded its computer capability. Although most bills are sent to mortgage holding institutions, those residents who receive tax bills directly have noticed that the computer is providing a far greater amount of detailed information about each tax.

In addition, to paying online, Town taxpayers now have the ability to pay their taxes via credit and debit cards (MasterCard, VISA, American Express and Discover) in our Oyster Bay tax office. Please note there is a fee involved. New York State law mandated that the Town of Oyster Bay receives no portion of the service fee – this fee is retained by the payment processing vendors enabling the transaction. Residents can access online information on this website just by CLICKING HERE.

The Office of Receiver of Taxes supplies information with regard to property tax exemptions for veterans, senior citizens and clergy.

The Receiver of Taxes is elected every four years.

Tax Exemptions

Tax Exemptions

Info on Home Improvement Property Tax Exemptions, Veterans’ Real Property Tax Exemptions, STAR Exemption, Senior Citizen Real Property Tax Exemption.

Grievances

Grievances

Important information for taxpayers on filing a grievance regarding their property’s assessed value.

Real Estate Closing Information

Real Estate Closing Information

Information for residents who are buying or selling a home.

Frequently Asked Questions

Frequently Asked Questions

This section offers a wealth of tax information including where your tax dollar goes and when to pay your taxes.

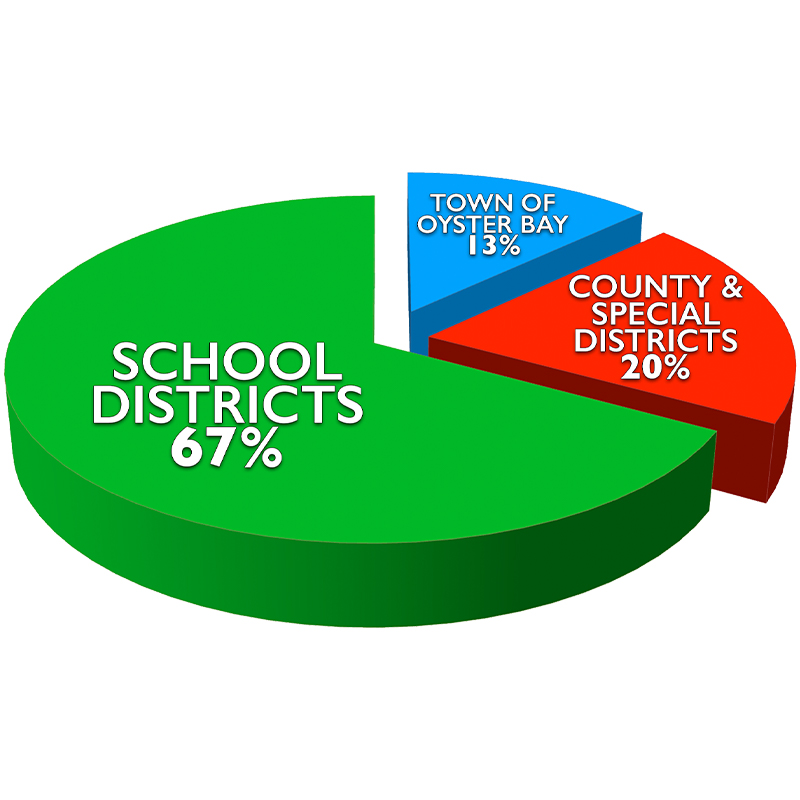

Where Does Your Tax Dollar Go?

Where Does Your Tax Dollar Go?

Information on tax rates and how your tax dollar is distributed.